Sequoia AlphaSeries 1

Sequoia Alpha Series 1 - DNCA Invest Alpha Bonds

Sequoia Alpha Series 1 (“Series 1”) is a structured investment whereby investors obtain 100% leverage and exposure to any positive performance of the NXS DNCA Alpha Bonds ER VT 5% Index (”the Reference Asset or Index”) over a 3 year period with the potential to receive an uncapped Performance Coupon at Maturity dependent on the Index Performance, adjusted for changes in the AUD/USD exchange rate during the Investment Term.

* This represents an indicative level for unwinding your investment on the reporting date and is an indication of the market value of the investment.

Summary of the key features

The NXS DNCA Alpha Bonds ER VT 5% Index

The Index is an excess return index designed to track the extent to which performance of the Underlying Fund exceeds the Euribor 3 Month Rate (Bloomberg: EUR003M <Index>) subject to a 5% target volatility mechanism and 150% maximum participation rate. In other words, the index aims to capture the “alpha” generated by the Underlying Fund above the Euribor 3 Month Rate.

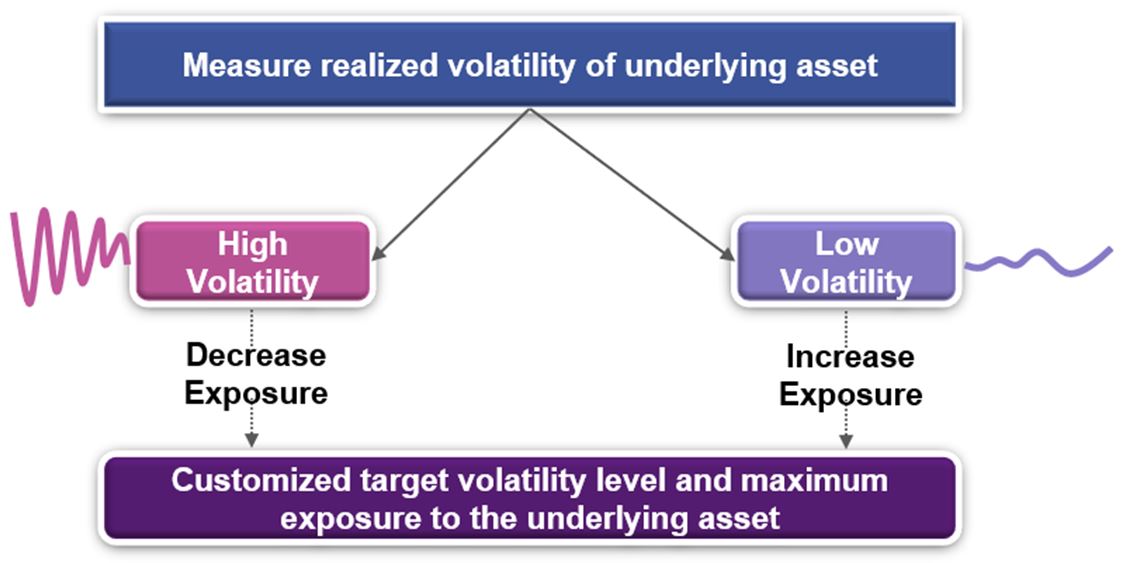

On a daily basis, in order to limit negative performance in extreme market conditions, a risk control mechanism is used inside the Index. It ensures that the volatility of the Index will remain close to the 5% target by reducing the Index’s exposure to the Underlying Fund in situations where the annualised realized volatility of the Underlying Fund’s unit price exceeds 5%. The maximum level of exposure is 150% and the minimum level of exposure is 0%.

It might be helpful for investors to be aware that it is because of the risk management included inside the Index targeting 5% realised volatility that the Issuer is able to offer a relatively low interest rate of 2.05% p.a. in connection with a 100% limited recourse loan. This is because the cost of the hedge obtained from the Hedge Counterparty is much lower than it would otherwise be if the Index did not include the above risk management feature targeting a realised volatility of 5%.

The volatility control mechanism may provide some protection against decreases in the prices of the Underlying Fund however it may also limit the Index’s (and the Unit’s) exposure to increases in the unit prices of the Underlying Fund being tracked by the Index. This means there is a risk that the volatility control mechanism could result in a lower Performance Coupon being payable relative to if the Index did not include a volatility control mechanism.

For further details on how this is calculated, please contact the Issuer at Email: specialistinvestments@sequoia.com.au

The Underlying Fund: About DNCA Investments

DNCA Investments is the manager of the Underlying Fund (“Manager”). The Manager was founded in 2000 and specialises in a conviction-based investment approach across different assets classes, management styles, and geographical regions.

The Manager’s experienced team develops investment products for private and institutional clients, with an investment offering organised around five areas of expertise (fixed income, absolute return, multi-asset, equities, and socially responsible investment).

As at 31 March 2023, the Manager operates 46 funds totalling €29.5 billion in AUM.

The Underlying Fund seeks to provide, throughout the recommended investment period of three years or more, a higher performance, net of any fees, than the €STR index plus 2%. This performance objective is sought by associating it to a lower annual volatility than 5% in normal market conditions.

Investments are made through a combination of strategies, including:

- a short/long directional strategy aimed at optimising portfolio performance based on interest rate and inflation expectations; and

- a yield curve strategy to take advantage of changes in the spreads between long-term and short-term rates; and

- an arbitrage strategy to seek relative value within various bond asset classes; and

- a credit strategy based on the use of corporate bonds.

The Underlying Fund will at all times invest up to 25% of its total assets in bonds denominated in any currency of non-OECD issuers. The Underlying Fund will only invest in securities with a rating of at least B- by Standard & Poor’s or considered equivalent, at the time of purchase. Fixed income securities that may be downgraded during their lifetime below B- may not exceed 10% of the total assets of the portfolio.

The Underlying Fund invests primarily in fixed rate, floating rate and inflation-linked debt securities and negotiable debt, within the following limits:

- convertible or exchangeable bonds: up to 100% of its total assets and conditional convertible bonds (Coco bonds): up to 20% of its total assets;

- equities (through exposure to convertible bonds, synthetic convertible bonds or options on the equity futures market): the Fund may have up to 10% exposure to the stock market.

The Underlying Fund may invest up to 10% of its net assets in units and/or shares of UCITS and/or Alternative Investment Funds (AIFs).

The Underlying Fund will use all types of eligible derivatives traded on regulated or over-the-counter markets where such contracts are more appropriate to the management objective or have lower trading costs. These instruments may include, but are not limited to: futures, options, swaps, index CDS and CDS. The Underlying Fund may invest in securities denominated in any currency. Exposure to currencies other than the reference currency may be hedged into the reference currency to limit currency risk, which will not exceed 30% of the total assets of the Underlying Fund.

The Underlying Fund is actively managed and uses a benchmark for the calculation of the performance fee and for performance comparison. To this end, the Manager’s investment decisions are made in order to achieve the management objective; in particular, decisions regarding asset selection and the overall level of market exposure. The Manager is not constrained by the benchmark in positioning the portfolio and may deviate in whole or in part from the composition of the benchmark.

Please refer to the following link for further details in relation to the Underlying Fund:

Find out more about Sequoia Specialist Investments

Complete the form below and we’ll be in touch as soon as possible.

Downloads

To find out more, and to download a copy of the Term Sheet PDS and Master PDS, please click on the links below

Find out more about Sequoia Specialist Investments

Complete the form below and we’ll be in touch as soon as possible.

Find out more about Sequoia Specialist Investments

Complete the form below and we’ll be in touch as soon as possible.

Key risks include:

- Risk of 100% loss in relation to the Total Investment Cost and Upfront Adviser Fee. The Total Investment Cost equals the Prepaid Interest in relation to the Loan and the Application Fee. Investors may also incur an Upfront Adviser Fee in addition. A 100% loss will occur if there is no Performance Coupon paid at Maturity. This will be the case if the Index Performance is less than or equal to zero on the Maturity Date;

- Risk of partial loss (i.e. less than 100% loss) in relation to the Total Investment Cost and Upfront Adviser Fee. The Total Investment Cost equals the Prepaid Interest in relation to the Loan and the Application Fee. Investors may also incur an Upfront Adviser Fee in addition. Investors may incur a partial loss if the Performance Coupon at Maturity is less than the Break-Even Point;

- Timing risks. The timing risk is significant. This is because the Investment Term is fixed and the Performance Coupon received at the end of the Investment Term needs to exceed the Total Investment Cost by the time the Maturity Date arrives in order for the investor to generate a profit from their investment (ignoring any Upfront Adviser Fee and any external costs). If this does not occur by the Maturity Date then Investors will generate a loss;

- The Performance Coupon at Maturity is determined by reference to the Index Performance as well as the change in the AUD/USD exchange rate during the Investment Term. An increase in the AUD/USD exchange rate between the Commencement Date and the Maturity Date will reduce any potential Performance Coupon payable (if any) whilst a decrease in the AUD/USD rate between the relevant dates will lead to an increase in the potential Performance Coupon payable (if any). As such, whether or not you break-even depends on both the Index Performance and the AUD/USD exchange rate performance during the Investment Term;

- Volatility and exposure risk – the volatility control mechanism used by the Index means that if there is high volatility in the relevant underlying portfolio during the Investment Term there is a risk the Index will have little to no exposure to this portfolio during some or all of the Investment Term, which may provide some protection against decreases in the prices of the portfolio comprising the Index however it may also limit the Index’s (and the Units’) exposure to increases in the prices of the relevant portfolio comprising the Index. To the extent the Index has an exposure primarily to cash as a result of the volatility control mechanism, the Index will be unlikely to generate the Index Performance required for investors to generate a profit;

- There is no guarantee that the Units will generate returns in excess of the Prepaid Interest and Fees, during the Investment Term;

- Additionally, in the event of an Investor requested Issuer Buy-Back or Early Maturity Event, you will not receive a refund of your Prepaid Interest or Fees. The amount received will depend on the market value of the Units which will be determined by many factors before the Maturity Date including prevailing interest rates in Australia and internationally, foreign exchange rates, the remaining time to Maturity, and general market risks and movements including the volatility of the Index. Investors should be aware the Units are designed to be held to Maturity and are not designed to be held as a trading instrument;

- Gains (and losses) may be magnified by the use of a 100% Loan. However, note that the Loan is a limited recourse Loan, so you can never lose more than your Prepaid Interest Amount and Fees paid at Commencement.

- Investors are subject to counterparty credit risk with respect to the Issuer and the Hedge Counterparty; and

- the Units may mature early following an Early Maturity Event, including an Adjustment Event, Market Disruption Event or if the Issuer accepts your request for an Issuer Buy-Back.

Please refer to Section 2 “Risks” of the Master PDS for more information.

Units in Sequoia Alpha Series 1 are issued by Sequoia Specialist Investments Pty Ltd (ACN 145 459 936) (the “Issuer”) and arranged by Sequoia Asset Management Pty Ltd (ACN 135 907 550, AFSL 341506) (the “Arranger”). Investments in the Sequoia Alpha Series 1 can only be made by completing an Application Form attached to the Term Sheet PDS, after reading the Term Sheet PDS dated 1 September 2023, the Master PDS dated 17 August 2017 and Target Market Determination (for retail investors) and submitting it to Sequoia. A copy of the Termsheet PDS, Master PDS and Target Market Determination can be obtained by contacting Sequoia Asset Management or contacting your financial adviser. You should consider the Term Sheet & Master PDS’s as well as the Target Market Determination before deciding whether to invest in Units in Sequoia Alpha Series 1. Capitalised terms on the webpage have the meaning given to them in Section 10 “Definitions” of the Master PDS.

Find out more about Sequoia Specialist Investments

Complete the form below and we’ll be in touch as soon as possible.