Future Tech

Series 4

Future Tech Series 4

Sequoia Future Tech – Series 4 aims to provide investors with the opportunity to take advantage of numerous emerging trends developing across a variety of technology sectors. It achieves this by delivering exposure to a widely diversified portfolio of global companies which are in the process of commercializing new innovative technologies as they arise around the world.

* Unit Value: Investors, please note this is a theoretical investment maturity value. This investment is designed to be held to maturity. Any investors seeking to redeem prior to maturity may receive an amount significantly different to the Indicative Unit Value stated.

The Units in Sequoia Future Tech – Series 4 offer investors the ability to gain 100% leveraged exposure to the Nasdaq Yewno Global Innovative Technologies ER Index (“the Reference Asset or Index”) over a 2 year period. The Units have the potential to pay an uncapped Performance Coupon at Maturity dependent on the Index Performance adjusted for changes in the AUD/USD exchange rate during the Investment Term (“the Series Performance”).

Nasdaq Yewno Global Innovative Technologies ER Index

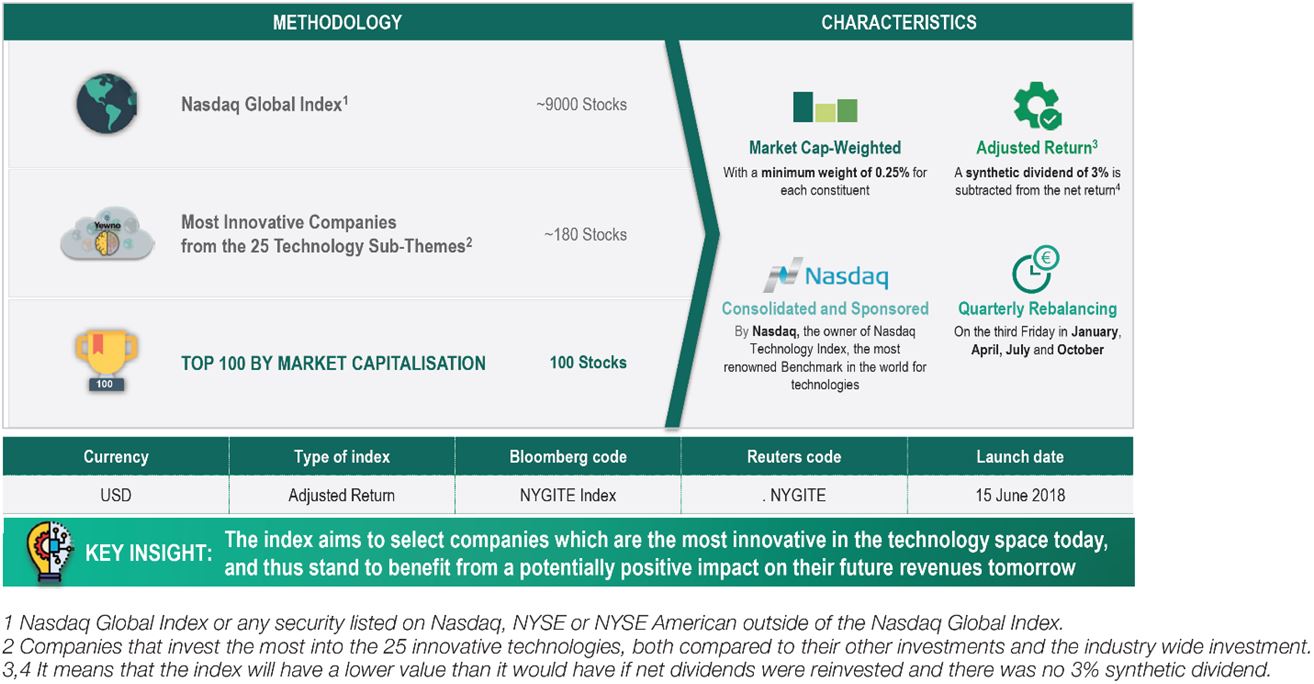

The Nasdaq Yewno Global Innovative Technologies ER Index is designed to track a portfolio of global stocks across 6 key sectors and 25 subsectors that are expected to drive technological advancement and economic growth in the years to come. This is illustrated below:

Yewno Inc – Using Artificial Intelligence to Identify the Most Innovative Companies

Yewno, Inc. is a Silicon Valley based start up and a leading provider of Computational Linguistics, Network Theory, Machine Learning, and Artificial Intelligence solutions that extracts insights and delivers products and services tailored to a number of industries, including Finance. Nasdaq Global Indexes has partnered with Yewno Inc. with the aim of “enhancing the benchmarking and classification of companies engaged in emerging and disruptive technologies across all industries”*. Making use of Yewno Inc’s Artificial Intelligence system, the Index analyses the extent to which a company has intellectual property and invests in research and development through their patent data linked to 6 innovative technology sectors and 25 sub-themes (see table above). Since research and development spending of a company is not necessarily reflected in its current revenue but is rather more likely realized in its future revenue, the Index relies on Yewno to select companies which are likely to be innovative in their space based on the patents they own.

Stock Selection Process

Summary of the key features

Find out more about Sequoia Specialist Investments

Complete the form below and we’ll be in touch as soon as possible.

Downloads

To find out more, and to download a copy of the Flyer, Term sheet PDS, Target Market Determination and Master PDS, please click on the links below

Find out more about Sequoia Specialist Investments

Complete the form below and we’ll be in touch as soon as possible.

Important Information

Find out more about Sequoia Specialist Investments

Complete the form below and we’ll be in touch as soon as possible.

Key risks include:

- Risk of 100% loss in relation to the Total Investment Cost and Upfront Adviser Fee. The Total Investment Cost equals the Prepaid Interest in relation to the Loan and the Application Fee. Investors may also incur an Upfront Adviser Fee in addition. A 100% loss will occur if there is no Performance Coupon paid At Maturity. This will be the case if the Index Performance is zero or negative at Maturity;

- Risk of partial loss (i.e. less than 100% loss) in relation to the Total Investment Cost and Upfront Adviser Fee. The Total Investment Cost equals the Prepaid Interest in relation to the Loan and the Application Fee. Investors may also incur an Upfront Adviser Fee in addition. Investors may incur a partial loss if the Performance Coupon at Maturity is less than the Break-Even Point;

- Timing risks. The timing risk associated with Series 4 is significant. This is because the Investment Term is fixed and the Series Performance needs to exceed the Break-Even Point by the time the Maturity Date arrives in order for the investor to generate a profit from their investment (ignoring any Upfront Adviser Fee and any external costs). If this does not occur then Investors will generate a loss;

- Any Performance Coupon at Maturity is determined by reference to the Index Performance adjusted for changes in the AUD/USD exchange rate during the Investment Term. An increase in the AUD/USD exchange rate between the Commencement Date and the Maturity Date will reduce any Performance Coupon payable whilst a decrease in the AUD/USD rate between the relevant dates will lead to an increase in any Performance Coupon payable. As such, whether or not you break-even depends on both the Index Performance and the AUD/USD exchange rate performance during the Investment Term;

- There is no guarantee that the Units will generate returns in excess of the Prepaid Interest and Fees, during the Investment Term;

- Additionally, in the event of an Investor requested Issuer Buy-Back or Early Maturity Event, you will not receive a refund of your Prepaid Interest or Fees. The amount received will depend on the market value of the Units which will be determined by many factors before the Maturity Date including prevailing interest rates in Australia and internationally, foreign exchange rates, the remaining time to Maturity, and general market risks and movements including the volatility of the Index. Investors should be aware the Units are designed to be held to Maturity and are not designed to be held as a trading instrument;

- Gains (and losses) may be magnified by the use of a 100% Loan. However, note that the Loan is a limited recourse Loan, so you can never lose more than your Prepaid Interest Amount and Fees paid at Commencement;

- Investors are subject to counterparty credit risk with respect to the Issuer and the Hedge Counterparty; and

- The Units may mature early following an Early Maturity Event, including an Adjustment Event, Market Disruption Event or if the Issuer accepts your request for an Issuer Buy-Back.

Please refer to Section 2 “Risks” of the Master PDS for more information.

For more information, please contact Sequoia at:

invest@sequoia.com.au and 02 8114 2222.

Units in Sequoia Future Tech Series 4 are issued by Sequoia Specialist Investments Pty Ltd (ACN 145 459 936 ) (the “Issuer”) and arranged by Sequoia Asset Management Pty Ltd (ACN 135 907 550, AFSL 341506) (the “Arranger”). Investments in the Sequoia Future Tech Series 4 can only be made by completing an Application Form attached to the Term Sheet PDS, after reading the Term Sheet PDS dated 25 April 2022 and the Master PDS dated 14 August 2017 and submitting it to Sequoia. A copy of the PDS can be obtained by contacting Sequoia Asset Management on or contacting your financial adviser. You should consider the Term Sheet & Master PDS’ before deciding whether to invest in Units in Sequoia Future Tech Series 4. Capitalised terms on the webpage have the meaning given to them in Section 10 “Definitions” of the Master PDS.

Find out more about Sequoia Specialist Investments

Complete the form below and we’ll be in touch as soon as possible.