CommoditiesSeries 1

Commodities Series 1 - Diversified Commodities Index Long Only

The Units in Sequoia Commodities Series 1 offer 100% leveraged exposure to the BNP Paribas Energy & Metals Enhanced Roll ER Index (”the Reference Asset or Index”) with a 15% Target Volatility mechanism over a 2 year period and the potential to receive an uncapped Performance Coupon at Maturity dependent on the Strategy Value Performance, adjusted for changes in the AUD/USD exchange rate during the Investment Term.

Sequoia Commodities - Series 1 Performance

| Date | Reference Asset Level | Indicative Unit Value* | Performance |

|---|---|---|---|

| 28-May-2021 | 101.61 | $1.02 | 1.61% |

| 30-Jun-2021 | 102.86 | $1.11 | 2.86% |

| 30-Jul-2021 | 106.77 | $1.13 | 6.77% |

| 31-Aug-2021 | 106.03 | $1.12 | 6.03% |

| 30-Sep-2021 | 109.28 | $1.16 | 9.28% |

| 29-Oct-2021 | 109.87 | $1.168 | 9.87% |

| 30-Nov-2021 | 103.90 | $1.121 | 3.90% |

| 31-Dec-2021 | 107.50 | $1.140 | 7.50% |

| 31-Jan-2022 | 110.96 | $1.177 | 10.96% |

| 28-Feb-2022 | 117.30 | $1.276 | 17.30% |

| 31-Mar-2022 | 130.40 | $1.333 | 30.40% |

| 30-Apr-2022 | 134.05 | $1.355 | 34.05% |

| 31-May-2022 | 135.73 | $1.389 | 35.73% |

| 30-Jun-2022 | 129.19 | $1.323 | 29.19% |

| 29-Jul-2022 | 129.19 | $1.318 | 29.19% |

| 31-Aug-2022 | 128.83 | $1.320 | 28.83% |

| 30-Sep-2022 | 121.11 | $1.248 | 21.11% |

| 31-Oct-2022 | 123.15 | $1.25 | 23.15% |

| 30-Nov-2022 | 128.03 | $1.285 | 28.03% |

| 30-Dec-2022 | 123.51 | $1.237 | 26.85% |

| 31-Jan-2023 | 122.87 | $1.223 | 25.15% |

| 28-Feb-2023 | 117.751 | $1.182 | 20.41% |

| 31-Mar-2023 | 118.7447581 | $1.195 | 21.611% |

| 28-Apr-2023 | 117.202 | $1.185 | 20.139% |

* This represents an indicative level for unwinding your investment on the reporting date and is an indication of the market value of the investment.

** The Gross Performance refers to the performance of either the underlying Reference Asset or Strategy Value as at the end of the relevant month, whichever is applicable depending on the terms of the Termsheet PDS.

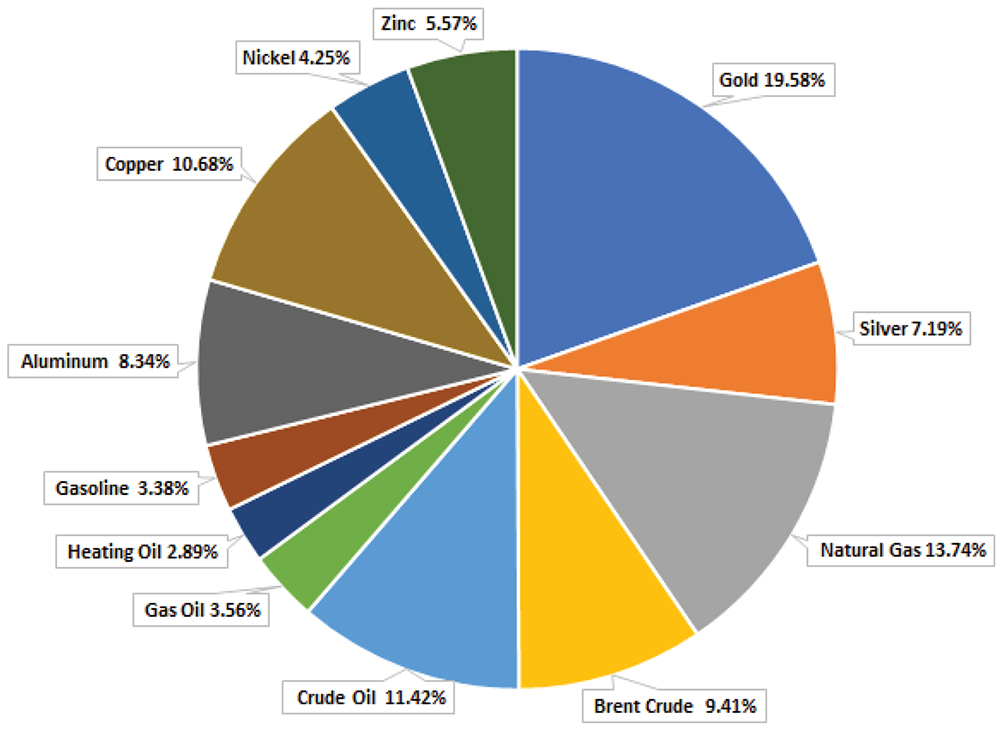

The Index offers a long only, diversified exposure to the commodity asset class, excluding Agriculture and Livestock. The key features of Index are outlined below:

- Diversification across 3 commodity sectors using the same sector diversification of the industry benchmark commodity index known as the as the Bloomberg ex- Agriculture and Livestock Capped Total Return Index (“The Industry Benchmark Index”):

1) Industrial Metals;

2) Precious Metals; and

3) Energy

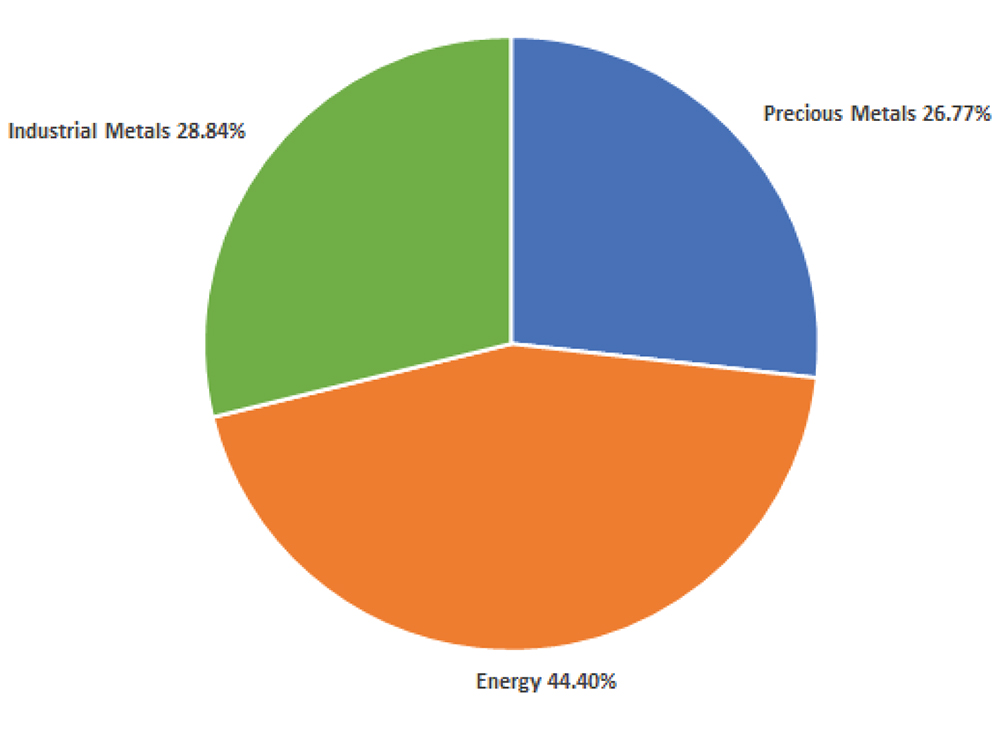

As at 15 April 2021, the sector allocation of the Index was:

- The individual commodity weights within the Index are calculated by reference to the following:

1) As a first step it uses the same weights as those included in the Industry Benchmark Index. The Industry Benchmark Index uses liquidity and production data to determine the weights of each commodity within that index;

2) As a second step, a daily weight capping mechanism is applied to ensure that the sum of the weights for all commodities included within the Energy sector does not exceed 35% and that no individual commodity within the Index exceeds 20% on a daily basis.

Find out more about Sequoia Specialist Investments

Complete the form below and we’ll be in touch as soon as possible.

Downloads

To find out more, and to download a copy of the Term sheet PDS and Master PDS, please click on the links below

Find out more about Sequoia Specialist Investments

Complete the form below and we’ll be in touch as soon as possible.

Reference Asset Starting Value

Find out more about Sequoia Specialist Investments

Complete the form below and we’ll be in touch as soon as possible.

Key Risks Key risks include:

- Your return (including any Performance Coupon) is affected by the performance of the Reference Asset. There is no guarantee that the Reference Asset will perform well.

- There will be no Performance Coupon payable if the performance of the Reference Asset is negative at Maturity;

- The potential Performance Coupon is determined by reference to the Reference Asset Performance as well as changes in the AUD/USD exchange rate. An increase in the AUD/USD exchange rate between the Commencement Date and the Maturity Date will reduce the Performance Coupon whilst a decrease in the AUD/USD rate between the relevant dates will lead to an increase in the Performance Coupon;

- There is no guarantee that the Units will generate returns in excess of the Prepaid Interest and Fees, during the Investment Term. Additionally, in the event of an Investor requested Issuer Buy-Back or Early Maturity Event, you will not receive a refund of your Prepaid Interest or Fees.

- Gains (and losses) may be magnified by the use of a 100% Loan. However, note that the Loan is a limited recourse Loan, so you can never lose more than your Prepaid Interest Amount and Fees paid at Commencement.

- Investors are subject to counterparty credit risk with respect to the Issuer and the Hedge Counterparty; and

- the Units may mature early following an Early Maturity Event, including an Adjustment Event, Market Disruption Event or if the Issuer accepts your request for an Issuer Buy-Back.

Please refer to Section 2 “Risks” of the Master PDS for more information.

For more information, please contact Sequoia at:

invest@sequoia.com.au and 02 8114 2222.

Units in Sequoia Commodities Series 1 are issued by Sequoia Specialist Investments Pty Ltd (ACN 145 459 936 ) (the “Issuer”) and arranged by Sequoia Asset Management Pty Ltd (ACN 135 907 550, AFSL 341506) (the “Arranger”). Investments in the Sequoia Commodities Series 1 can only be made by completing an Application Form attached to the Term Sheet Product Disclosure Statement (“TSPDS”), after reading the Term Sheet PDS dated 19 April 2021 and the Master PDS dated 14 August 2017 and submitting it to Sequoia. A copy of the PDS can be obtained by contacting Sequoia Asset Management on or contacting your financial adviser. You should consider the Term Sheet & Master PDS’ before deciding whether to invest in Units in Sequoia Commodities Series 1. Capitalised terms on the webpage have the meaning given to them in Section 10 “Definitions” of the Master PDS

Find out more about Sequoia Specialist Investments

Complete the form below and we’ll be in touch as soon as possible.

February 27, 2024

February 2024: Are you US equity markets due for a correction?

Sequoia Financial Group introduces US Equity Hedge Series: A timely strategy for…

June 9, 2022

The inflation conundrum and where to invest?

The Russian invasion into Ukraine has presented challenges for investors which has…

March 14, 2022

Global market reaction on Ukraine crisis, inflation & commodities

The Russian invasion into Ukraine has presented challenges for investors which has…