When reviewing the financial news lately, plenty has been said about rising inflation in recent months. This has been especially the case for the United States where the closely watched inflation gauge, the Consumer Price Index (CPI), exploded to a 40 year high in March 2022 with a reading of 8.5% from a year earlier. This reflected prices soaring on everything from petrol, food, transportation and housing.

Until March 2022, the US Federal Reserve (“the Fed”) Chairman Powell, had been suggesting during 2021 that the rising inflation was merely transitory as a result of the low base effects coming from 2020. However, this suggestion was quickly put to bed in March and the Fed had no choice but to change its course on interest rates as a result of the sudden change in inflation expectations. This is a quote from the Minutes of the Federal Open Market Committee March 15–16, 2022.

Following the Russian invasion of Ukraine and the subsequent imposition of an array of sanctions…global financial conditions tightened, reflecting declines in equity prices, increases in sovereign yields and credit spreads, and— for the United States— an appreciation of the dollar. Prices of commodities that Russia exports, particularly oil and natural gas, soared over the period. While oil prices partially retracted late in the period, options prices suggested considerable probability that oil prices could remain elevated or rise further in the months ahead. Alongside the rise in commodities prices, measures of near term inflation compensation increased sharply across advanced economies.

With inflation rising rapidly not just in the US but across many other parts of the world, various central bankers have been forced to use the only lever available to them in an attempt to bring it under control: higher interest rates.

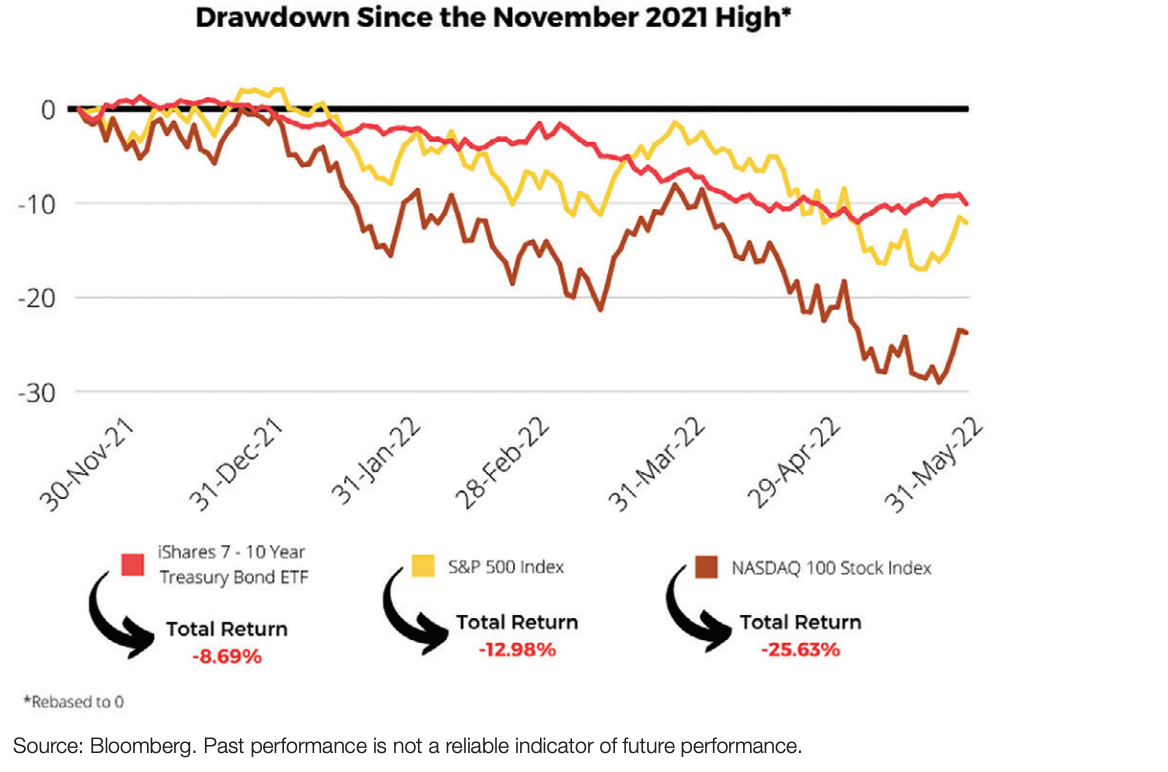

Bonds and equities have been falling in response, as was evidenced in the sharp move lower in both the S&P 500 and 7–10 year US treasury bond prices over the last 6 months.

The inflation conundrum

This does present a conundrum for investors with traditionally diversified equity/bond portfolios. If bonds and equities are falling, what other investments can be considered that can be reasonably expected to add value to portfolios during periods of high inflation?

Before answering this question, lets dig a little deeper to try and understand the economic mechanism through which higher inflation leads to lower bond and equity prices.

So why does high inflation drive markets lower?

Given bond yields reflect the combination of:

- future expected interest rates;

- inflation expectations; and

- a risk premium,

a rise in both inflation and interest rates means that investors will demand higher yields from bonds. This forces bond prices lower in order to achieve a higher yield given the inverse relationship between bond prices and yields.

Impact on Tech Shares

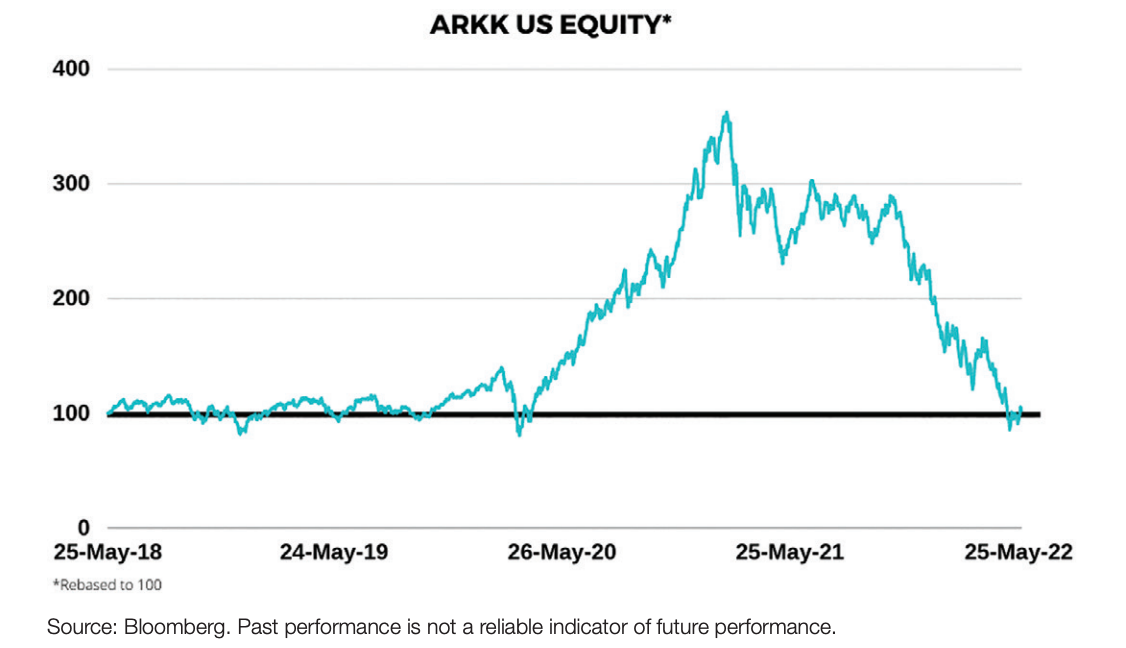

Equities, on the other hand, fall for a variety of reasons. Technology shares with high levels of leverage and valuations based on expected future revenue streams (rather than strong current operational revenues), tend to be hit the hardest. The rise in funding costs directly impacts the bottom line. This brought into question some of the exuberant valuations of various tech shares listed on the Nasdaq leading into November 2021. Many of these valuations now appear to have been heavily reliant upon the extremely low interest rate regime. The best example of this is the ARK Innovation ETF managed by Cathie Wood, which invested in many companies focusing on future disruption.

Notwithstanding the above, there does come a point when some of these tech shares might ironically start offering a value opportunity to investors who have the right stock picking skill, not to mention risk appetite.

Impact on broader equity markets

Greater economic uncertainty due to high inflation also impacts the wider equity markets as companies find it harder to plan, invest, grow and engage in long term contracts. Moreover, although companies with market power can increase prices to mitigate the impact of an unexpected surge in costs, many smaller companies are unable to pass on the full increase in costs to their customers. Margins could therefore shrink putting pressure on wages. Further, higher inflation can lead to a fall in consumer sentiment and general economic weakness. Higher living costs through higher mortgage payments, rents, petrol and grocery costs can lead to lower disposable income (unless wages increase to a similar extent) meaning less discretionary spend. If we have less construction due to greater uncertainty over project completion costs or property prices start to fall due to higher interest rates, this can lead to lower consumer sentiment and concern for the future.

Some analysts are not expecting a sudden reversal in fortunes for the wider equity and bond markets, and we believe the S&P 500 for example could continue to remain under pressure at least until US inflation starts to show signs of not just coming back under control but reversing back towards more reasonable levels of 2–3% p.a.

Notwithstanding the above, we believe it is important for investors to understand what is driving inflation higher and whether these underlying drivers can be expected to continue into the future. If so, then it makes sense for investors to consider inflation hedging solutions for their portfolios.

What is driving inflation?

We believe the major drivers of inflation over the last few years are as follows:

- Covid lockdowns crushing many supply chains and giving rise to shortages across various commodities;

- The global clean transition away from fossil fuels in response to climate change leading to oil and natural gas pipelines, oil drilling leases and coal fired power plants being cancelled and planned to close;

- The Ukraine/Russia war and subsequent sanctions imposed on Russia and the impact this is having on the supply of Natural Gas, Oil, Nickel and Wheat to mention a few; the EU agreeing to ban 90% of all Russian oil import by the end of 2022 is a good example. Will demand for oil be destroyed to the same extent to which it will be removed from the market by the end of the year, or will there be another source of supply entering the market which replaces that which is withdrawn due to the EU ban on Russian oil; and

- Increasing food protectionism as some Asian countries in particular prevent the export of various commodities reducing global supplies (e.g. India’s recent ban on wheat exports).

Will a rise in interest rates really bring inflation under control?

We further believe that unless the world suddenly sees a resolution to the conflict in Ukraine and a sudden backflip on global climate change policies, the above-mentioned inflation drivers are here to stay for the foreseeable future. This is the case especially for Agricultural commodities and energy. Increasing interest rates will also do nothing to address these issues in our opinion. Interest rates can reduce demand but they do not fix disrupted supply chain or outright shortages. If anything, interest rates could further increase input costs for companies due to higher funding costs leading to higher consumer prices.

For these reasons, we believe high US inflation should therefore continue into at least the 2023/2024 period. As such, it can still make a lot of sense to consider an allocation to possible inflation hedging solutions until this fundamental picture changes.

What other asset classes can investors consider during a high inflationary environment?

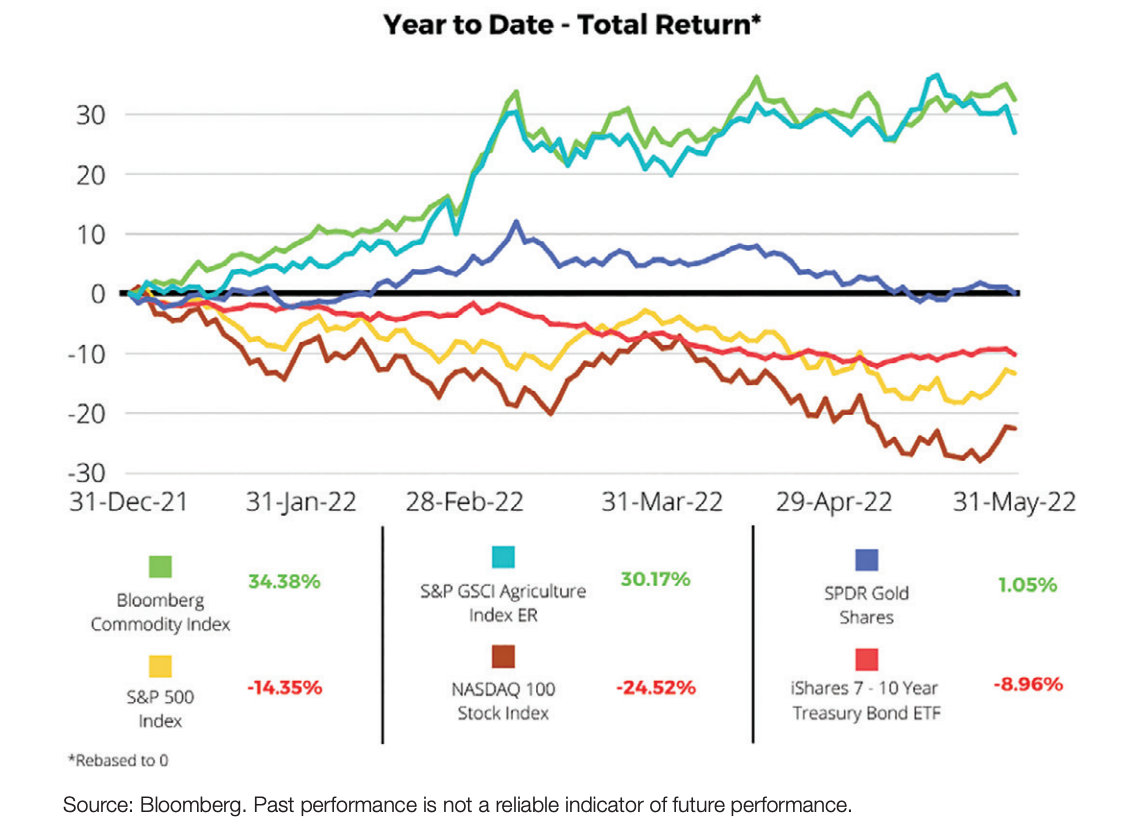

So how can investors reallocate part of their portfolios to hedge against the impact of inflation? Rather than focusing on history for an answer to this question, lets focus on asset price movements over the last 6 months. The reason we prefer the approach is because the cause of inflation today is very different to the many high inflationary episodes of the past. i.e. Inflation today is caused by supply shortages and not excessive speculative demand.

Firstly, we can say for certain that one asset class that has outperformed the rest since the highs formed in tech shares in November 2021 is commodities.

The reason for this is obvious. If commodity prices are increasing then the cost of raw materials is increasing which leads to higher consumer prices. This is most obvious with energy and the cost of petrol, electricity and some food items. The fact that the US excludes food and energy form the calculation of CPI makes no difference. These are real world inflation measures.

How to invest in commodities

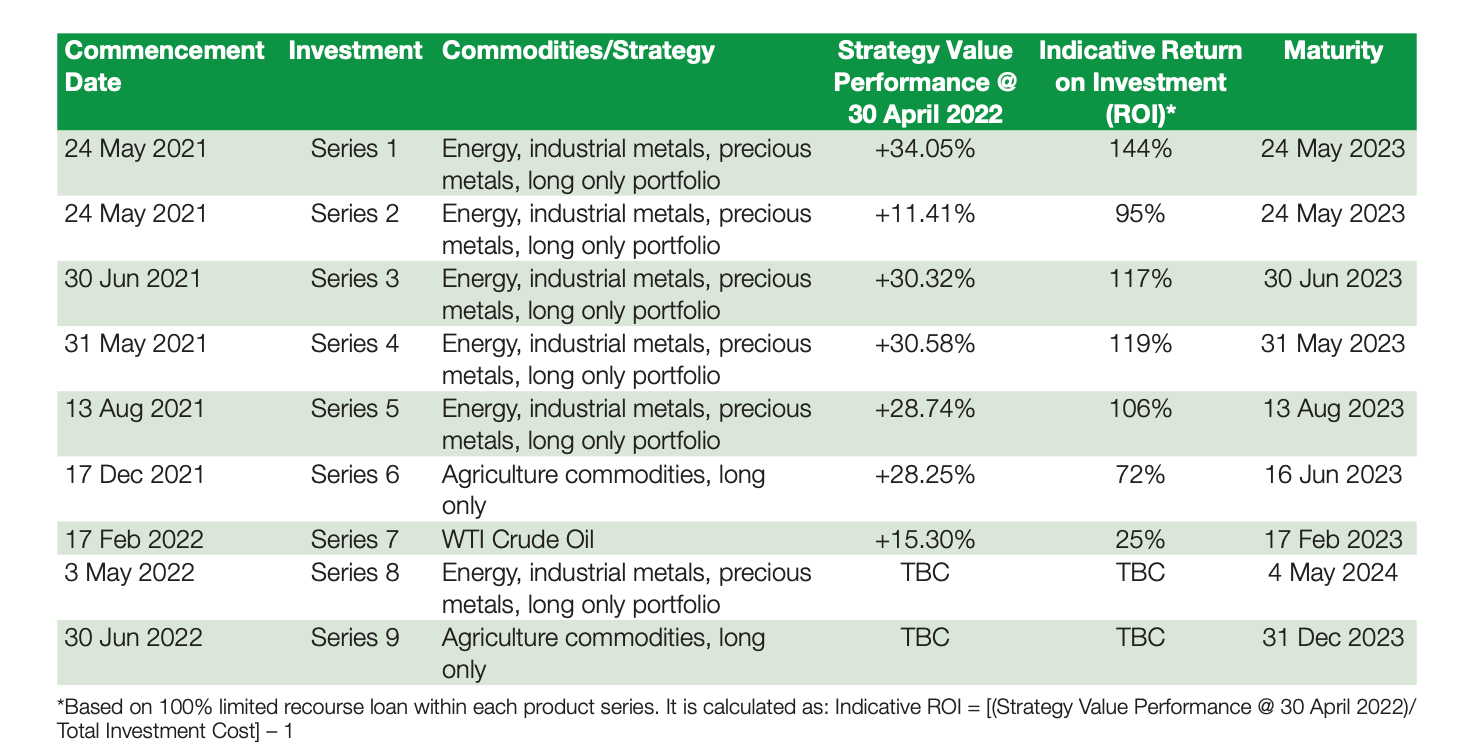

This for the most part can be rather difficult. Unfortunately, in Australia there is no direct commodity investment listed on the ASX. There are direct commodity ETFs listed in the US which can be considered, however, this may force investors to crystallize losses or lower potential gains on their Equity or Bond portfolios which many investors will be reluctant to do. To this end, Sequoia Specialist Investments have been offering a variety of commodity investment solutions over the last 12 months which require only a small portfolio allocation to obtain a much larger exposure. Please refer to the link below and the summary table for their performance @ 30 April 2022.

Key risks in relation to the investments listed above generally include the following:

- Risk of 100% loss or partial loss in relation to the Total Investment Cost and Upfront Adviser Fee specified in the Term Sheet PDS or Term Sheet IM;

- Significant timing risk because the Investment Term is fixed and the performance of the Strategy Value or Index (adjusted for change sin the AUD/USD exchange rate) needs to exceed the Total Investment Cost and Adviser Fee by the Maturity Date in order for investors to generate a profit;

- There is no guarantee that the Units will generate returns in excess of the Prepaid Interest and Fees, during the Investment Term; and

- Gains (and losses) may be magnified by the use of a 100% Loan. However, note that the Loan is a limited recourse Loan, so you can never lose more than your Prepaid Interest Amount and Fees paid at Commencement.

For a full description of all the risks associated with each of the above listed investments, please refer to the relevant Term Sheet PDS or IM and Master PDS or IM as per the relevant page of each investment found at: https://www.sequoiasi.com.au/commodities/

Yours sincerely,

Blair Kirkhope

Head of Specialist Investments Sequoia Specialist Investments Pty Ltd

Level 7, 7 Macquarie Place,

Sydney NSW 2000

Email: invest@sequoia.com.au

Ph:02 8114 2203