Capital Protected

Series 1 & 2

Capital Protected Series 1 & 2 - Capital Protected Investments linked to the performance of the Macquarie MQCP900F Index

Capital Protected Series 1 & 2 are 2 year investments offering investors capital protected exposure to the performance the Macquarie MQCP900F Index (”the Reference Asset or Index”) during the Investment Term, fully currency hedged into AUD.

* This represents an indicative level for unwinding your investment on the reporting date and is an indication of the market value of the investment.

Capital Protected Series 1 (“Series 1”) offers 100% capital protection at Maturity with the potential to receive an Uncapped Performance Coupon at Maturity dependent on a 130% Internal Gearing Rate applied to the performance of the Macquarie MQCP900F Index adjusted for changes in the AUD/USD exchange rate during the Investment Term.

Capital Protected Series 2 (“Series 2”) offers 95% capital protection at Maturity with the potential to receive an Uncapped Performance Coupon at Maturity dependent on a 200% Internal Gearing Rate applied to the performance of the Macquarie MQCP900F Index adjusted for changes in the AUD/USD exchange rate during the Investment Term. The index performance for Series 2, multiplied by the Internal Gearing Rate and adjusted for changes AUD/USD exchange rate, needs to be at least +5% by maturity in order for investors to receive at least 100% return of capital at maturity.

Summary of the key features

The Macquarie MQCP900F Index

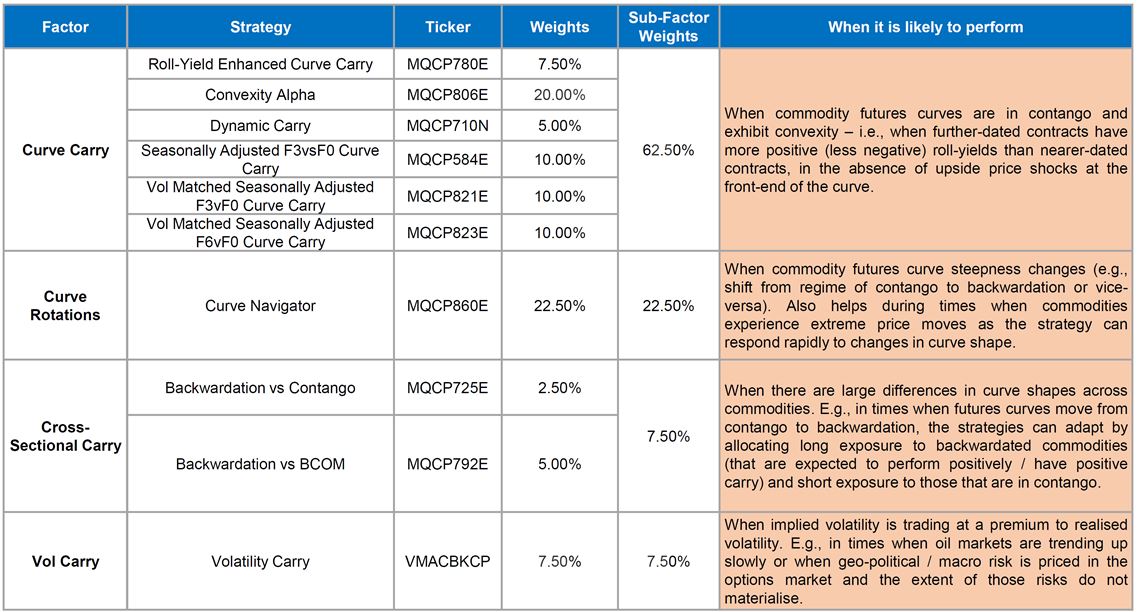

The Index is comprised of a basket of diversified commodity carry strategies, incorporating 10 strategies across four risk premia factors. The Index utilises a static weighting scheme based on the inverse volatility of each factor to determine the weight of each component in the basket before applying a 5% volatility control mechanism.

The key features of the Index include:

- Alternative source of return: The Index captures the investment return of 10 strategies across four risk premia factors;

- Long/Short: The component indices have a combination of both long and short exposures. As such, they have the ability to generate positive returns irrespective of the direction of the relevant underling market (however this does not mean that the Index return will be positive);

- Low Correlation to Global Equities: As at 31 July 2024 the Index has exhibited a low correlation to global equities; and

- Pricing efficiency: The Index has been designed to allow efficient pricing of structured products such as Sequoia Capital Protected Series 1 & 2.

The Macquarie MQCP900F Index is a fixed weight basket tracking the following underlying risk premia strategies.

For further details on how this is calculated, please contact the Issuer at Email: specialistinvestments@sequoia.com.au.

The 5% volatility control mechanism is a technique which dynamically adjusts exposure to the underlying 10 strategies based on the prevailing level of volatility. This potentially provides investors with more stable performance and reduced drawdowns whilst enabling a lower cost of hedging for the Issuer thereby enabling a lower interest rate.

If the recent volatility of the underlying portfolio exceeds 5%, the target exposure will be less than 100%, and the residual weight will be uninvested. If the recent volatility of the underlying portfolio of strategies is below 5%, the target exposure to underlying portfolio of strategies will be more than 100%, subject to max. leverage level of 400%. The weightings listed above are applicable to the invested portion of the Index. The index also includes a fee of 2% p.a. which is deducted from the performance of the underlying 10 strategies, after applying the internal leverage inside the index (max 400%), when calculating the index returns.

Find out more about Sequoia Specialist Investments

Complete the form below and we’ll be in touch as soon as possible.

Downloads

To find out more, and to download a copy of the Termsheet IM and Master IM, please click on the links below

Find out more about Sequoia Specialist Investments

Complete the form below and we’ll be in touch as soon as possible.

Find out more about Sequoia Specialist Investments

Complete the form below and we’ll be in touch as soon as possible.

Key risks include:

- Any Uncapped Performance Coupons is affected by the performance of the Index. There is no guarantee that the Index will perform well during the Investment Term;

- There will be no Uncapped Performance Coupons payable if the Index Performance is negative at a Maturity. In this case investors will incur the opportunity cost of any investment return that would have otherwise been generated if they had invested the capital into any other form of investment that had either paid income or appreciated in price during the Investment Term.

- Risk of partial loss of invested capital for Series 2 assuming investors hold to Maturity and the Uncapped Performance Coupon is less than 5%. The Index Performance, adjusted for changes in the AUD/USD exchange rate, needs to be at least +5% at Maturity in order for investors to receive a 100% return of capital under Series 2. The maximum loss is 5% of invested capital in the event there is no Performance Coupon under Series 2 at Maturity.

- The Uncapped Performance Coupon at Maturity is determined by reference to the Index Performance as well as the change in the AUD/USD exchange rate during the Investment Term. An increase in the AUD/USD exchange rate between the Commencement Date and the Maturity Date will reduce any potential Uncapped Performance Coupon payable (if any) whilst a decrease in the AUD/USD rate between the relevant dates will lead to an increase in the potential Uncapped Performance Coupon payable (if any).

- Volatility and exposure risk – the volatility control mechanism used by the Index means that if there is high volatility in the relevant underlying portfolio during the Investment Term there is a risk the Index will have little to no exposure to this portfolio during some or all of the Investment Term, which may provide some protection against decreases in the prices of the portfolio comprising the Index however it may also limit the Index’s (and the Units’) exposure to increases in the prices of the relevant portfolio comprising the Index. To the extent the Index has an exposure primarily to cash as a result of the volatility control mechanism, the Index will be unlikely to generate the Index Performance required for investors to generate a profit;

- Investor’s capital is at risk in the case an Investor makes an Issuer Buy-Back Request or if the Units are subject to an Early Maturity Event or Adjustment Event. Therefore, the amount received by an Investor may be less than the Issue Price even if the Reference Asset has performed positively since the Commencement Date and the date that the Investor makes an Issuer Buy-Back request or any date on which the Units become subject to an Early Maturity Event or Adjustment Event.

- Investors are subject to counterparty credit risk with respect to the Issuer and the Hedge Counterparty, as such, capital protection depends on the creditworthiness of the Issuer and Hedge Counterparty. If the Issuer or Hedge Counterparty goes into liquidation or receivership or statutory management or is otherwise unable to meet its debts as they fall due, the Investor could receive none, or only some, of the amount invested. However, in the case of the Issuer, the Issuer is a special purpose vehicle that only issues Deferred Purchase Agreement or other structured products and has put in place a corporate structure which is designed to give Investors security over the Issuer’s rights against the relevant Hedge Counterparty (through the Hedge Security Deed and Security Trust Deed) in the event of the Issuer becoming insolvent.

- The Units include a risk of capital loss in part or in whole, in the event the Hedge Counterparty fails to meet its obligations under the Hedge Agreement entered into with the Issuer.

- Investors should be aware that credit ratings do not constitute a guarantee of the quality of the Units, the Reference Asset, or the Hedge Counterparty. The rating assigned to the Hedge Counterparty by the rating agencies, if any, is based on the Hedge Counterparty’s current financial condition and reflects only the rating agencies’ opinions. In respect of the Hedge Counterparty, rating agencies do not evaluate the risks of fluctuation in market value but attempt to assess the likelihood of principal and/or interest payments being made. A credit rating is not a recommendation to buy, sell or hold securities and may be subject to revision, suspension or withdrawal at any time by the assigning agency. Nevertheless, the rating agencies may fail to make timely changes in credit ratings in response to subsequent events so that a Hedge Counterparty’s current financial condition may be better or worse than a rating indicates. Accordingly, a credit rating issued in relation to the issuer of the Notes acquired by the Issuer as a hedge may not fully reflect the true credit risks under the Units.

- the Units may mature early following an Early Maturity Event, including an Adjustment Event, Market Disruption Event or if the Issuer accepts your request for an Issuer Buy-Back. A risk of capital loss exists in any of these scenarios.

- Investors who purchase Units in the Secondary Offer Period at an Issue Price greater than the Initial Issue Price of $1.00 per unit will receive a lower overall return, as the Final Value and Coupons are calculated with respect to the Initial Issue Price of $1.00 per Unit. Additionally, if there is an Early Maturity Event, an Investor who purchased Units at an Issue Price greater than the Initial Issue Price of $1.00 will incur a greater loss as the recovery of funds in an Early Maturity Event would be based on the Initial Issue Price of $1.00 per Unit;

- Default Event (by the Hedge Counterparty). The Units may mature early (Early Maturity Event) following an event occurring in relation to the Hedge Counterparty or the Reference Asset, which may be caused by the Hedge Counterparty or any guarantors of the Hedge Counterparty;

Please refer to Section 2 “Risks” of the Master PDS for more information.

Units in Capital Protected Series 1 & 2 are issued by Sequoia Specialist Investments Pty Ltd (ACN 145 459 936) (the “Issuer”) and arranged by Sequoia Asset Management Pty Ltd (ACN 135 907 550, AFSL 341506) (the “Arranger”). Investments in the Capital Protected Series 1 & 2 can only be made by completing an Application Form attached to the Term Sheet IM, after reading the Term Sheet IM dated 10 September 2024, the Master IM dated 14 March 2024 and submitting it to Sequoia. A copy of the Termsheet IM and Master IM can be obtained by contacting Sequoia Asset Management or contacting your financial adviser. You should consider the Term Sheet & Master before deciding whether to invest in Units in Capital Protected Series 1 & 2. Capitalised terms on the webpage have the meaning given to them in Section 10 “Definitions” of the Master IM.

Find out more about Sequoia Specialist Investments

Complete the form below and we’ll be in touch as soon as possible.