LaunchSeries 33

Launch Series 33

Picture this. You walk into a bank and they offer you a loan to borrow funds at 1.99%pa and they will lend you 100% of the value of the asset (for property investors, think of it as a 100% LVR). The bank also explains to you that the loan is limited recourse, meaning, you will not be personally liable for any shortfall on the loan if for whatever reason the asset underperforms. Worth more of a look?

Launch Series 33 (Global Funds) Performance

| Date | Strategy Value | Reference Basket | Indicative Unit Value* | Gross Performance** |

|---|---|---|---|---|

| 31-Dec-2017 | 100.02 | n/a | $1.0002 | 0.02% |

| 31-Jan-2018 | 100.30 | n/a | $1.0030 | 0.30% |

| 28-Feb-2018 | 99.22 | n/a | $1.0000 | -0.78% |

| 31-Mar-2018 | 99.310 | n/a | $1.0000 | -0.69% |

| 30-Apr-2018 | 99.200 | n/a | $1.0000 | -0.80% |

| 31-May-2018 | 99.080 | n/a | $1.0000 | -0.92% |

| 29-Jun-2018 | 98.450 | n/a | $1.0000 | -1.55% |

| 31-Jul-2018 | 98.240 | n/a | $1.0000 | -1.76% |

| 31-Aug-2018 | 98.090 | n/a | $1.0000 | -1.91% |

| 28-Sep-2018 | 97.860 | n/a | $1.0000 | -2.14% |

All unit holders have unwound from the investment. Therefore, we will not be reporting performance for Launch Series 33.

* Indicative Unit Value: Investors please note this represents the market value of the investment as at the end of the relevant month and is different to the Gross Performance. Any investors seeking to redeem their investment on any other dates may receive an amount significantly different to the Indicative Unit Value stated.

**The Gross Performance refers to the performance of either the underlying Reference Asset or Strategy Value as at the end of the relevant month, whichever is applicable depending on the terms of the Termsheet PDS.

Objective – Deliver Positive Returns Regardless of Market Conditions

Now, what if you borrowed this money to buy an investment that was specifically designed with an objective to deliver positive returns to investors regardless of market conditions over a 4 year period.

Sequoia Launch Series 33

Sequoia Launch Series 33 has been developed with this precisely in mind. A new innovative investment product that gives:

- investors exposure to a diversified basket of global investment funds. The basket has the objective of delivering positive returns, regardless of market conditions;

- funds managed by some of the world’s largest and oldest asset managers;

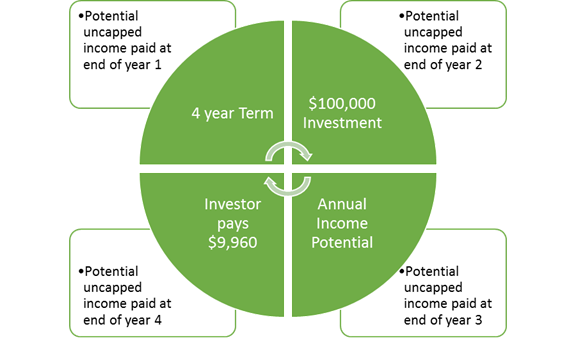

- a 4 year, 100% Loan that is limited recourse with interest rates of only 1.99%pa;

- potential annual Performance Coupons (uncapped) based on the full leveraged investment amount.

- AUD currency hedged.

Cashflows at Commencement

Investors pay four years of interest at 1.99%p.a and a one off 2% application fee upfront for the 4 year investment term and can potentially receive uncapped Performance Coupons at the end of each year.

Upfront Cash Flow requirements*

*excluding any Adviser Fees as negotiated between the Investor and their Adviser.

Find out more about Sequoia Specialist Investments

Complete the form below and we’ll be in touch as soon as possible.

Downloads

To find out more, and to download a copy of the Flyer, Term sheet PDS and Master PDS, please click on the links below

Find out more about Sequoia Specialist Investments

Complete the form below and we’ll be in touch as soon as possible.

Initial Strategy Value

Performance Coupons

Find out more about Sequoia Specialist Investments

Complete the form below and we’ll be in touch as soon as possible.

Key risks

- Your return is affected by the performance of the Reference Basket. There is no guarantee that the Reference Asset or Reference Basket will perform well. If the Reference Asset or Reference Basket performs negatively during the Investment Term you could lose some or all of your invested capital.

- The Units for Series 33 have varying levels of exposure to the Reference Basket depending on volatility due to the variable Participation Rate. It operates by varying the exposure that the Units will have to the Reference Basket depending on the Realised Volatility of the Reference Basket and the Target Volatility. There is the risk that the Participation Rate could drop to significantly below 100% during the Investment Term in which case Investors will not gain the full benefits of an increase of the value of the Reference Asset.

- Investors in Series 33 should note that there is a lag in measuring the Realised Volatility of the Reference Asset. This means that where there has been a period of high Realised Volatility, the Investor’s exposure to the Reference Asset will be low, regardless of whether the Reference Asset is performing positively or negatively.

- Series 33 uses leverage which amplifies both the losses and gains of your investment, however you can never lose more than your Initial Outlay (consisting of Prepaid Interest & any Fees).

- There is no guarantee that the Investment will achieve its objective. There is no guarantee that the Units will generate returns in excess of any Interest and Fees during the Investment Term. Additionally, in the event of an Investor requested Issuer Buy-Back or Early Maturity Event you will not receive a refund of any Interest or Fees.

- Investors are subject to counterparty credit risk with respect to the Issuer and the Hedge Counterparty;

- The Units may mature early following an Early Maturity Event, including an Adjustment Event, Market Disruption Event or if the Issuer accepts your request for an Issuer Buy-Back.

Please refer to Section 4 “Key Risks” of the Term Sheet PDS and Section 2 “Risks” of the Master PDS for more information.

For more information, please contact Sequoia at:

invest@sequoia.com.au and 02 8114 2222.

Units in Sequoia Launch Units – Series 33 are issued by Sequoia Specialist Investments Pty Ltd (ACN ) (the “Issuer”) and arranged by Sequoia Asset Management Pty Ltd (ACN , AFSL 341506)(the “Arranger”). Investments in the Sequoia Launch Units – Series 33 can only be made by completing an Application Form attached to the Sequoia Launch Series 33 Term Sheet Product Disclosure Statement (“TSPDS”) dated 23 November 2017, after reading the Master PDS dated 14 August 2017 and submitting it to Sequoia. A copy of the TSPDS, PDS and any other information can be obtained by contacting Sequoia Asset Management on or contacting your financial adviser. You should consider the Term Sheet & Master PDS’ before deciding whether to invest in Units in Sequoia Launch Units – Series 33. Capitalised terms on the webpage have the meaning given to them in Section 10 “Definitions” of the Master PDS.

Find out more about Sequoia Specialist Investments

Complete the form below and we’ll be in touch as soon as possible.