LaunchSeries 28

Launch Series 28

Picture this. You walk into a bank and they offer you a loan to borrow funds at 1.99%pa and they will lend you 100% of the value of the asset (for property investors, think of it as a 100% LVR). The bank also explains to you that the loan is limited recourse, meaning, you will not be personally liable for any shortfall on the loan if for whatever reason the asset underperforms. Worth more of a look?

Launch Series 28 (Global Funds) Performance

| Date | Strategy Value | Reference Basket | Indicative Unit Value* | Gross Performance** |

|---|---|---|---|---|

| 31-Jul-2017 | 100.50 | n/a | $1.005 | 0.50% |

| 31-Aug-2017 | 100.96 | n/a | $1.0096 | 0.96% |

| 31-Oct-2017 | 102.17 | n/a | $1.0217 | 2.17% |

| 31-Dec-2017 | 101.47 | n/a | $1.0147 | 1.47% |

| 31-Jan-2018 | 101.96 | n/a | $1.0196 | 1.96% |

| 28-Feb-2018 | 100.88 | n/a | $1.0088 | 0.88% |

| 31-Mar-2018 | 100.880 | n/a | $1.0088 | 0.88% |

| 30-Apr-2018 | 100.830 | n/a | $1.0083 | 0.83% |

| 31-May-2018 | 100.810 | n/a | $1.0081 | 0.81% |

| 29-Jun-2018 | 100.060 | n/a | $1.0006 | 0.06% |

| 31-Jul-2018 | 99.700 | n/a | $1.0000 | -0.30% |

| 31-Aug-2018 | 99.690 | n/a | $1.0000 | -0.31% |

| 28-Sep-2018 | 99.430 | n/a | $1.0000 | -0.57% |

| 31-Oct-2018 | 98.290 | n/a | $1.0000 | -1.71% |

| 30-Nov-2018 | 97.160 | n/a | $1.0000 | -2.84% |

| 31-Dec-2018 | 97.130 | n/a | $1.0000 | -2.87% |

| 31-Jan-2019 | 97.42 | n/a | $1.0000 | -2.58% |

| 28-Feb-2019 | 97.47 | n/a | $1.0000 | -2.53% |

| 29-Mar-2019 | 97.88 | n/a | $1.0000 | -2.12% |

| 30-Apr-2019 | 97.34 | n/a | $1.0000 | -2.66% |

| 31-May-2019 | 97.19 | n/a | $1.0000 | -2.81% |

| 28-Jun-2019 | 97.74 | n/a | $1.0000 | -2.26% |

| 31-Jul-2019 | 97.38 | n/a | $1.0000 | -2.62% |

| 30-Aug-2019 | 97.470 | n/a | $1.00 | -2.53% |

| 30-Sep-2019 | 96.92 | n/a | $1.00 | -3.08% |

| 31-Oct-2019 | 96.32 | n/a | $1.00 | -3.68% |

| 29-Nov-2019 | 96.32 | n/a | $1.00 | -3.68% |

| 31-Dec-2019 | 96.01 | n/a | $1.00 | -3.99% |

| 31-Jan-2020 | 96.01 | n/a | $1.00 | -3.99% |

| 28-Feb-2020 | 95.90 | n/a | $1.00 | -4.10% |

| 31-Mar-2020 | 94.39 | n/a | $1.00 | -5.61% |

| 30-Apr-2020 | 94.39 | n/a | $1.00 | -5.61% |

| 29-May-2020 | 94.56 | n/a | $1.00 | -5.44% |

| 30-Jun-2020 | 94.87 | n/a | $1.00 | -5.13% |

| 31-Jul-2020 | 95.49 | n/a | $1.00 | -4.51% |

| 31-Aug-2020 | 95.19 | n/a | $1.00 | -4.81% |

| 30-Sep-2020 | 95.55 | n/a | $1.00 | -4.45% |

| 30-Oct-2020 | 95.36 | n/a | $1.00 | -4.64% |

| 30-Nov-2020 | 95.68 | n/a | $1.00 | -4.32% |

| 30-Dec-2020 | 96.31 | n/a | $1.00 | -3.69% |

| 29-Jan-2021 | 97.32 | n/a | $1.00 | -2.68% |

| 25-Feb-2021 | 97.35 | n/a | $1.00 | -2.65% |

| 31-Mar-2021 | 98.52 | n/a | $1.00 | -1.48% |

| 30-Apr-2021 | 99.38 | n/a | $1.00 | -0.62% |

| 28-May-2021 | 100.21 | n/a | $1.00 | 0.21% |

* This represents an indicative level for unwinding your investment on the reporting date and is an indication of the market value of the investment.

**The Gross Performance refers to the performance of either the underlying Reference Asset or Strategy Value as at the end of the relevant month, whichever is applicable depending on the terms of the Termsheet PDS.

Objective – Deliver Positive Returns Regardless of Market Conditions

Now, what if you borrowed this money to buy an investment that was specifically designed with an objective to deliver positive returns to investors regardless of market conditions over a 4 year period.

Sequoia Launch Series 28

Sequoia Launch Series 28 has been developed with this precisely in mind. A new investment product that gives:

- investors exposure to a diversified basket of global investment funds. The basket has the objective of delivering positive returns, regardless of market conditions;

- funds managed by some of the world’s largest and oldest asset managers;

- a 4 year, 100% Loan that is limited recourse with interest rates of only 1.99%pa;

- potential annual Performance Coupons (uncapped) based on the full leveraged investment amount.

- AUD currency hedged.

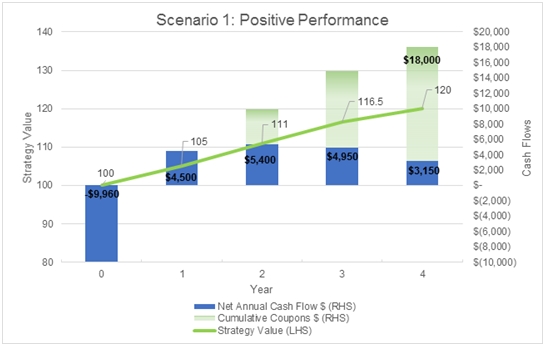

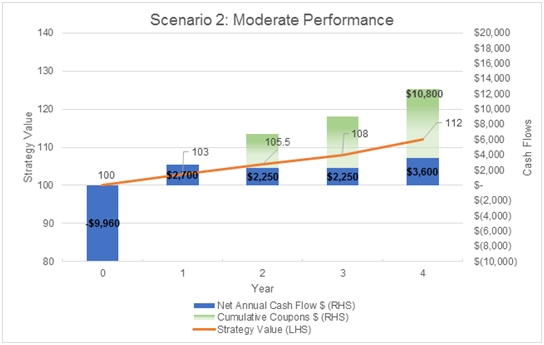

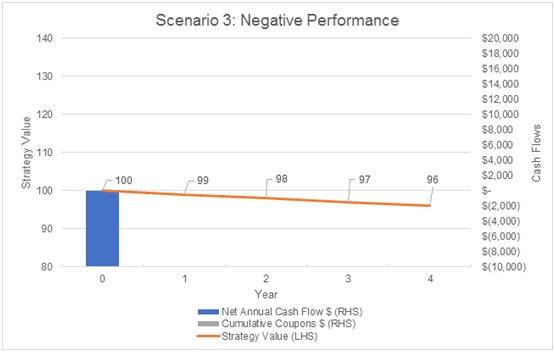

Simple Example – $100,000 investment ($9,960 total cash outlay).

For an initial outlay of only $9,960 (1.99% p.a x 4 yrs plus a one off 2% application fee) you will have a $100,000 investment for 4 years in Launch Series 28 which has the potential to pay uncapped annual distributions to investors in the form of Performance Coupons.

Three hypothetical scenarios are below to show the potential cash flows if an investment has positive, moderate or negative performance.

Scenario 1. Strategy Value increases from 100 to 120 (+20%) over the 4 year investment term.

Scenario 2. Strategy Value increases from 100 to 112 (+12%) over the 4 year investment term.

Scenario 3. Strategy Value decreases from 100 to 96 (-4%) over the 4 year investment term.

Find out more about Sequoia Specialist Investments

Complete the form below and we’ll be in touch as soon as possible.

Downloads

To find out more, and to download a copy of the Flyer, Term sheet PDS and Master PDS, please click on the links below

Find out more about Sequoia Specialist Investments

Complete the form below and we’ll be in touch as soon as possible.

Initial Strategy Value

Performance Coupons

Find out more about Sequoia Specialist Investments

Complete the form below and we’ll be in touch as soon as possible.

Key Risks

- Your return is affected by the performance of the Reference Basket. There is no guarantee that the Reference Asset or Reference Basket will perform well. If the Reference Asset or Reference Basket performs negatively during the Investment Term you could lose some or all of your invested capital.

- The Units for Series 28 have varying levels of exposure to the Reference Basket depending on volatility due to the variable Participation Rate. It operates by varying the exposure that the Units will have to the Reference Basket depending on the Realised Volatility of the Reference Basket and the Target Volatility. There is the risk that the Participation Rate could drop to significantly below 100% during the Investment Term in which case Investors will not gain the full benefits of an increase of the value of the Reference Asset.

- Investors in Series 28 should note that there is a lag in measuring the Realised Volatility of the Reference Asset. This means that where there has been a period of high Realised Volatility, the Investor’s exposure to the Reference Asset will be low, regardless of whether the Reference Asset is performing positively or negatively.

- There is no guarantee that the Investment will achieve its objective. There is no guarantee that the Units will generate returns in excess of any Interest and Fees during the Investment Term. Additionally, in the event of an Investor requested Issuer Buy-Back or Early Maturity Event you will not receive a refund of any Interest or Fees.

- Investors are subject to counterparty credit risk with respect to the Issuer and the Hedge Counterparty;

- The Units may mature early following an Early Maturity Event, including an Adjustment Event, Market Disruption Event or if the Issuer accepts your request for an Issuer Buy-Back.

Please refer to Section 4 “Key Risks” of the Term Sheet PDS and Section 2 “Risks” of the Master PDS for more information.

For more information, please contact Sequoia at:

invest@sequoia.com.au and 02 8114 2222.

Units in Sequoia Launch Units – Series 28 are issued by Sequoia Specialist Investments Pty Ltd (ACN ) (the “Issuer”) and arranged by Sequoia Asset Management Pty Ltd (ACN , AFSL 341506)(the “Arranger”). Investments in the Sequoia Launch Units – Series 28 can only be made by completing an Application Form attached to the Term Sheet Product Disclosure Statement (“TSPDS”), after reading the Master PDS dated 10 June 2015 and submitting it to Sequoia. A copy of the TSPDS, PDS and any other information can be obtained by contacting Sequoia Asset Management on or contacting your financial adviser. You should consider the Term Sheet & Master PDS’ before deciding whether to invest in Units in Sequoia Launch Units – Series 28. Capitalised terms on the webpage have the meaning given to them in Section 10 “Definitions” of the Master PDS.

Find out more about Sequoia Specialist Investments

Complete the form below and we’ll be in touch as soon as possible.