LaunchSeries 8

Launch Series 8

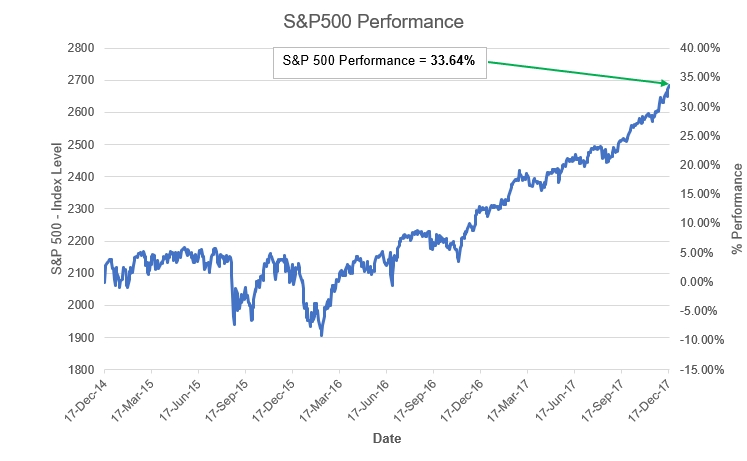

Launch Series 8 has matured on 18 December 2017 and it was up by 33.64% and it paid a Final coupon of 35.94% (thanks to a positive currency uplift). This equated to total return on investor’s cash outlay of 95.32% over the Investment term.

Launch Series 8 (S&P500) Performance

| Date | Reference Asset Level | Indicative Unit Value* | Gross Performance** |

|---|---|---|---|

| 31-Dec-2014 | 2058.90 | $1.0229 | 2.29% |

| 30-Jan-2015 | 1995.00 | $1.0000 | -0.89% |

| 27-Feb-2015 | 2104.50 | $1.0455 | 4.55% |

| 31-Mar-2015 | 2067.90 | $1.0273 | 2.73% |

| 30-Apr-2015 | 2085.51 | $1.0361 | 3.61% |

| 29-May-15 | 2107.40 | $1.0470 | 4.70% |

| 30-Jun-2015 | 2063.1 | $1.0249 | 2.49% |

| 31-Jul-2015 | 2103.84 | $1.0452 | 4.52% |

| 30-Sep-2015 | 1920.00 | $1.000 | -4.61% |

| 31-Oct-2015 | 2079.36 | $1.033 | 3.30% |

| 30-Nov-2015 | 2080.41 | $1.0335 | 3.35% |

| 31-Dec-2015 | 2043.94 | $1.0154 | 1.54% |

| 29-Jan-2016 | 1940.20 | $1.000 | -3.61% |

| 29-Feb-2016 | 1932.23 | $1.000 | -4.01% |

| 31-Mar-2016 | 2059.74 | $1.0233 | 2.33% |

| 30-Apr-2016 | 2065.30 | $1.026 | 2.60% |

| 31-May-2016 | 2096.50 | $1.0415 | 4.15% |

| 30-Jun-2016 | 2098.60 | $1.0426 | 4.26% |

| 29-Jul-2016 | 2173.60 | $1.0798 | 7.98% |

| 30-Aug-2016 | 2176.12 | $1.0811 | 8.11% |

| 30-Sep-2016 | 2168.27 | $1.0772 | 7.72% |

| 31-Oct-2016 | 2126.15 | $1.0563 | 5.63% |

| 30-Nov-2016 | 2198.81 | $1.0924 | 9.24% |

| 30-Dec-2016 | 2238.83 | $1.1122 | 11.22% |

| 31-Jan-2017 | 2278.90 | $1.1322 | 13.22% |

| 28-Feb-2017 | 2363.64 | $1.1743 | 17.43% |

| 31-Mar-2017 | 2362.72 | $1.1738 | 17.38% |

| 28-Apr-2017 | 2384.20 | $1.1845 | 18.45% |

| 31-May-2017 | 2411.80 | $1.1982 | 19.82% |

| 30-Jun-2017 | 2423.41 | $1.2039 | 20.39% |

| 31-July-2017 | 2470.30 | $1.2272 | 22.72% |

| 31-Aug-2017 | 2471.65 | $1.2279 | 22.79% |

| 31-Oct-2017 | 2575.26 | $1.2794 | 27.94% |

| 18-Dec-2017 | Matured | Matured | 35.94% (Final Coupon) |

* This represents an indicative level for unwinding your investment on the reporting date and is an indication of the market value of the investment.

**The Gross Performance refers to the performance of either the underlying Reference Asset or Strategy Value as at the end of the relevant month, whichever is applicable depending on the terms of the Termsheet PDS.

Sequoia Launch Series 8 Units give Investors with a positive view, the ability to make a leveraged investment with exposure to the US share market as measured by the S&P500 Price Return Index and the benefit of a 100% Limited Recourse Loan with Prepaid Interest for the 3 year Investment Term of $0.162 (5.40% p.a. per Unit).

Sequoia Launch Units Work Like This:

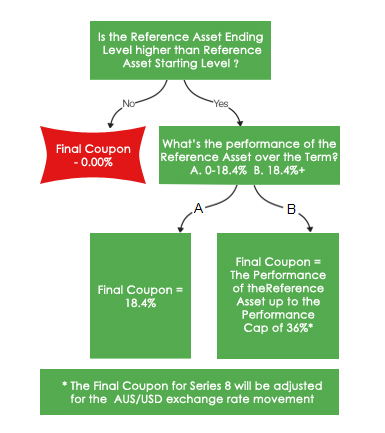

At the Maturity Date, Investors may receive a Final Coupon dependant on the performance of the Australian share market as measured by theUS share market as measured by the S&P500 Price Return Index (Series 8) ( the “Reference Asset”). The Final Coupon return will be calculated based on these movements.

How is the Final Coupon if the Reference Asset Ending Level is above the Reference Asset Starting Level, the Final Coupon per Unit will be $1.00 multiplied by the greater of:

- 18.4%; and

- the performance of the Reference Asset during the Investment Term subject to a Performance Cap of 36%*.

(*For Series 8, these amounts will be adjusted for the AUD/USD exchange rate movement.)

The payment of the Final Value and the Final Coupon at Maturity is summarised in the diagram below:

Find out more about Sequoia Specialist Investments

Complete the form below and we’ll be in touch as soon as possible.

Find out more about Sequoia Specialist Investments

Complete the form below and we’ll be in touch as soon as possible.

Starting Level

Currency

Find out more about Sequoia Specialist Investments

Complete the form below and we’ll be in touch as soon as possible.

Key Risks

- Your return is affected by the performance of the Reference Asset. There is no guarantee that the Reference Asset will perform well.

- There is no guarantee that the Units will generate returns in excess of the Prepaid Interest, Application Fee, Currency Management Fee (Series 8 only) and Adviser Fee (if any) during the Investment Term. Additionally, in the event of an Investor requested Issuer Buy-Back, Early Maturity Event or if you elect to repay your Loan before the Maturity Date, you will not receive a refund on Prepaid Interest, Application Fee, Currency Management Fee (Series 8 only) and Adviser Fee (if any).

- There will be no Final Coupon payable at Maturity if the Reference Asset Ending Level is the same or less than the Reference Asset Starting Level (i.e. the performance of the Reference Asset is flat or negative).

- Payment of the Final Coupon and the Final Value depends on the Issuer meeting its obligations and the Hedge Counterparty’s ability to meet their obligations under the Hedge. Investors are subject to counterparty credit risk with respect to the Issuer and the Hedge Counterparty.

- Gains (and losses) may be magnified by the use of a 100% Loan. However, note that the Loan is a limited recourse Loan, so you will never be required to pay more than the Prepaid Interest, Application Fee, Currency Management Fee (Series 8 only) and Adviser Fee (if any).

- The Units may mature early following an Early Maturity Event, including as a result of an Adjustment Event or Market Disruption Event or, if your request for an Issuer Buy-Back is accepted. If the Units are subject to Early Maturity for any reason, you will not be entitled to a refund of any Prepaid Interest, Application Fee, Currency Management Fee (Series 8 only) or Adviser Fee (if any) paid in relation to the Units.

Find out more about Sequoia Specialist Investments

Complete the form below and we’ll be in touch as soon as possible.