LaunchSeries 4

Launch Series 4

Sequoia Launch is the latest innovation from Sequoia Specialist Investments.

Launch Series 4 has matured on 30 June 2017. The investment will pay a Final Coupon of 23.63% to investors.

Launch Series 4 provides investors with exposure the US share market as measured by the S&P500 Price Return Index with hedged exposure to currency movements (the “Reference Asset“)

Launch Series 4 (S&P500) Performance

| Date | Reference Asset Level | Indicative Unit Value* | Gross Performance** |

|---|---|---|---|

| 30-Jun-2014 | 1960.23 | $1.00 | 0.00% |

| 31-Jul-2014 | 1903.70 | $1.00 | (1.51%) |

| 29-Aug-2014 | 2,003.40 | $1.022 | 2.20% |

| 30-Sep-2014 | 1972.30 | $1.0062 | 0.62% |

| 31-Oct-2014 | 2018.05 | $1.0295 | 2.95% |

| 28-Nov-2014 | 2067.00 | $1.0545 | 5.45% |

| 31-Dec-2014 | 2058.90 | $1.0503 | 5.03% |

| 30-Jan-2015 | 1995.00 | $1.0177 | 1.77% |

| 27-Feb-2015 | 2104.50 | $1.0736 | 7.36% |

| 31-Mar-2015 | 2067.90 | $1.0549 | 5.49% |

| 30-Apr-2015 | 2085.51 | $1.0639 | 6.39% |

| 29-May-15 | 2107.40 | $1.0751 | 7.51% |

| 30-Jun-2015 | 2063.1 | $1.0525 | 5.25% |

| 31-Jul-2015 | 2103.84 | $1.0733 | 7.33 |

| 31-Aug-2015 | 1972.20 | $1.0061 | 0.61% |

| 30-Sep-2015 | 1920.00 | $1.000 | -2.05% |

| 31-Oct-2015 | 2079.36 | $1.0608 | 6.08% |

| 30-Nov-2015 | 2080.41 | $1.0613 | 6.13% |

| 31-Dec-2015 | 2043.94 | $1.0427 | 4.27% |

| 29-Jan-2016 | 1940.20 | $1.000 | -1.02% |

| 29-Feb-2016 | 1932.23 | $1.000 | -1.43% |

| 31-Mar-2016 | 2059.74 | $1.058 | 5.08% |

| 30-Apr-2016 | 2065.30 | $1.0536 | 5.36% |

| 31-May-2016 | 2096.50 | $1.0695 | 6.95% |

| 30-Jun-2016 | 2098.86 | $1.0707 | 7.07% |

| 29-Jul-2016 | 2173.60 | $1.1088 | 10.88% |

| 30-Aug-2016 | 2176.12 | $1.1101 | 11.01% |

| 30-Sep-2016 | 2168.27 | $1.1061 | 10.61% |

| 31-Oct-2016 | 2126.15 | $1.0846 | 8.46% |

| 30-Nov-2016 | 2198.81 | $1.1217 | 12.17% |

| 30-Dec-2016 | 2238.83 | $1.1421 | 14.21% |

| 31-Jan-2017 | 2278.90 | $1.1626 | 16.26% |

| 28-Feb-2016 | 2363.64 | $1.2058 | 20.58% |

| 31-Mar-2017 | 2362.72 | $1.2053 | 20.53% |

| 28-Apr-2017 | 2384.20 | $1.2163 | 21.63% |

| 31-May-2017 | 2411.80 | $1.2304 | 23.04% |

| 30-Jun-2017 | 2423.41 | $1.2362889 (matured) | 23.62889% (Final Coupon) |

* This represents an indicative level for unwinding your investment on the reporting date and is an indication of the market value of the investment.

**The Gross Performance refers to the performance of either the underlying Reference Asset or Strategy Value as at the end of the relevant month, whichever is applicable depending on the terms of the Termsheet PDS.

The investment is a significant leap forward in leveraged investments, as it provides uncapped performance potential to your choice of Reference Asset, the benefit of a 100% Limited Recourse Loan with Prepaid Interest for the 3 year Investment Term of $0.162 (5.40% p.a. per Unit), Currency Hedging (Series 4) for 0.50%p.a and additionally, provided that the Reference Asset at maturity is higher than it was at the beginning of the investment, investors will receive at least their Interest (16.2%) back via a Final Coupon.

Sequoia Launch Units Work Like This:

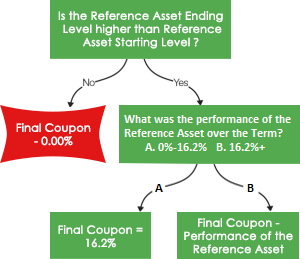

If the Reference Asset Ending Level is above the Reference Asset Starting Level, the Final Coupon per Unit will be $1.00 multiplied by the greater of:

- 16.2%; and

- the performance of the Reference Asset during the Investment Term.

The payment of the Final Value and the Final Coupon at Maturity is summarised in the diagram below:

Find out more about Sequoia Specialist Investments

Complete the form below and we’ll be in touch as soon as possible.

Download

Find out more about Sequoia Specialist Investments

Complete the form below and we’ll be in touch as soon as possible.

Starting Level

Find out more about Sequoia Specialist Investments

Complete the form below and we’ll be in touch as soon as possible.

Find out more about Sequoia Specialist Investments

Complete the form below and we’ll be in touch as soon as possible.