GrowthSeries 7

Growth Plan 7

The Sequoia Growth Plans 7 offers investors the potential to receive fixed growth returns, linked to a basket of the big four Australian bank shares:

ANZ, CBA, NAB and WBC.

Growth Plan 7 Performance

| Date | ANZ | CBA | NAB | WBC |

|---|---|---|---|---|

| 31-Oct-2017 | $29.92 (8.45%) | $77.63 (5.97%) | $32.66 (22.37%) | $32.99 (6.56%) |

Growth Plan 7:

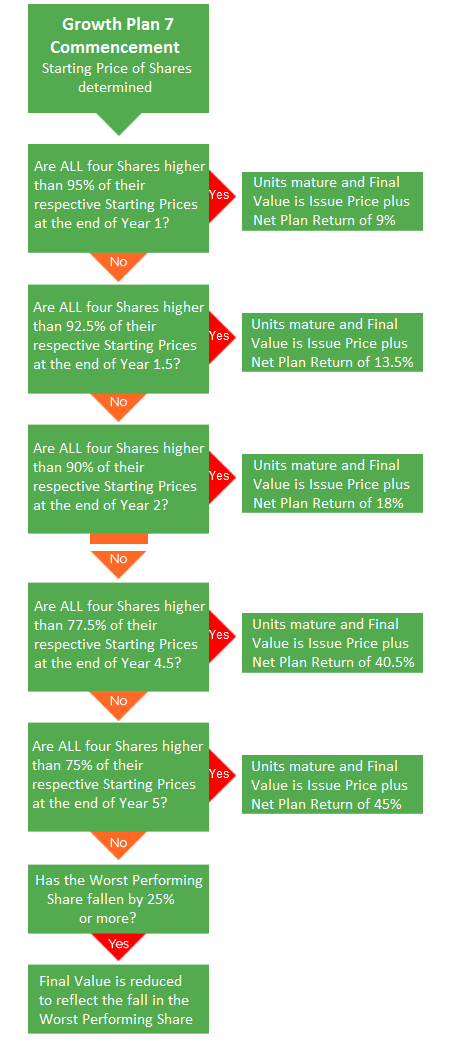

9.0% Potential Return for each year that’s passed provided that ALL Shares are higher than their respecitve Auto Call Level at an Auto Call Date (annually) (see flow chart below). Investors would be exposed to a loss, if after 5 years, one of the Shares has fallen 25% or more.

Investors have the potential to received 45% return plus their original capital after 5 years, even if the Worst Performing Share in the basket has fallen by up to 25%;

Find out more about Sequoia Specialist Investments

Complete the form below and we’ll be in touch as soon as possible.

Find out more about Sequoia Specialist Investments

Complete the form below and we’ll be in touch as soon as possible.

Initial Staring Prices

(used to determine an Auto Call Event or Knock In Event)

Sequoia Growth Plan 7, linked to a basket of bank shares (ANZ, CBA, NAB, WBC) had an Auto Call event on 14 November 2017, where all 4 shares closed above their respective Auto Call Levels (being 95% of their starting prices). This Auto Call event meant that the investment matures and in doing so, pays investor a Final Value of $1.09 per Unit.

Unit Price

*This represents an indicative level for unwinding your investment on the reporting date and is an indication of the market value of the investment.

Find out more about Sequoia Specialist Investments

Complete the form below and we’ll be in touch as soon as possible.

This flyer has been prepared by the Issuer for general promotional purposes only and is not an offer to sell or solicitation to buy any financial products. This flyer does not constitute personal advice and has been prepared without taking into account your objectives, financial situation or needs. You should consider obtaining professional advice as to whether this financial product suits your objectives, financial situation or needs before investing. The Issuer may, in its discretion, extend or shorten the Offer Period for the Units without prior notice. If this happens, the Commencement Date and one or more consequential dates for the Units may vary. The Issuer may also defer the Commencement Date for the Units, in which case the Maturity Dates and other consequential dates for the Units may vary. If the Issuer varies the Offer Period or the Commencement Date for the Units it will post a notice on the website informing applicants of the change at www.sequoiasi.com.au.

You should seek independent advice in relation to the tax implications of your investment.

Units in Sequoia Growth Plan 7 are issued by Sequoia Specialist Investments Pty Ltd (ACN 145 459 936) (the “Issuer”) and arranged by Sequoia Asset Management Ltd (ACN 094 107 034, AFSL 341506). Investments in the Sequoia Growth Plan 7 can only be made by completing an Application Form attached to the Term Sheet Product Disclosure Statement dated on or around 4 October 2016 (“Term Sheet PDS”) and submitting it to Sequoia Specialist Investments Pty Ltd (ABN 67 145459 936). A copy of the Term Sheet PDS and Master PDS can be obtained by contacting Sequoia Asset Management on 02 8114 2222, accessing them through Sequoia’s website at www.sequoiasi.com.au, or contacting your financial adviser. You should consider the Term Sheet PDS and Master PDS before deciding whether to invest in Units in Sequoia Growth Plan 7. Capitalised terms in this flyer have the meaning given to them in Section 8 “Definitions” of the Master PDS.

1 Indicative pricing as at 12 October 2016

2 The Closing Price on the Commencement Date (being 31 October 2016 until otherwise notified) of the each of the individual Shares comprising the Plan Basket. The Starting Price is used for determining the Knock-in Levels and Auto Call Levels.

3 The Minimum Plan Return required for the Issuer to proceed with the issue of the Plan is 8%. If the Minimum Plan Return for a Plan cannot be set at or above the relevant minimum level, the Issuer will not proceed with the issue of the Plan. The Issuer may alter the Commencement Date for a Plan, in which case the Maturity Date and other consequential dates for the Plan or Series may vary.

Find out more about Sequoia Specialist Investments

Complete the form below and we’ll be in touch as soon as possible.