GrowthSeries 1

Growth Plan 1

Growth Plan 1 matured on 12 Oct 2016 and paid investor an 18% return ($1.18 per Unit)

The Sequoia Growth Plans 1 offers investors the potential to receive fixed growth returns, linked to a basket of the big four Australian bank shares:

ANZ, CBA, NAB and WBC.

Investors, please note change of dates: Download here:

Growth Plan 1 Performance

| Date | ANZ | CBA | NAB | WBC |

|---|---|---|---|---|

| 30-Aug-2016 | $26.90 (-13.84%) | $71.81 (-3.58%) | $27.34 (-10.30%) | $29.46 (-3.28%) |

| 30-Sep-2016 | $27.63 (-11.50%) | $72.40 (-2.79%) | $27.87 (-8.56%) | $29.51 (-3.12%) |

| 31-Oct-2016 | $27.85 (-10.79%) | $73.39 (-1.46%) | $28.00 (-8.14%) | $30.47 (0.03%) |

| 30-Nov-2016 | $28.41 (-9.00%) | $78.65 (5.60%) | $28.93 (-5.09%) | $31.27 (2.66%) |

| 30-Dec-2016 | $30.42 (-2.56%) | $82.41 (10.65%) | $30.67 (0.62%) | $32.60 (7.03%) |

| 31-Jan-2017 | $29.29 (-6.18%) | $81.66 (9.64%) | $30.33 (0.49%) | $31.71 (4.10%) |

Growth Plan 1:

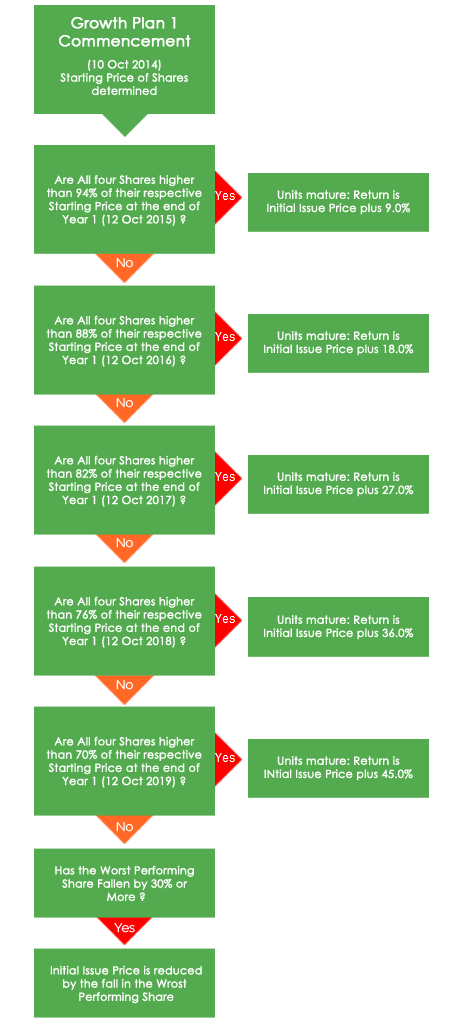

9.0% Potential Return for each year that’s passed provided that ALL Shares are higher than their respective Auto Call Level at an Auto Call Date (annually) (see flow chart below). Investors would be exposed to a loss, if after 5 years, one of the Shares has fallen 30% or more.

Find out more about Sequoia Specialist Investments

Complete the form below and we’ll be in touch as soon as possible.

Find out more about Sequoia Specialist Investments

Complete the form below and we’ll be in touch as soon as possible.

Initial Staring Prices

(used to determine an Auto Call Event or Knock In Event)

*New strike price following adjustment event for NAB on 7 May 2015 & 2 Feb 2016, CBA 12 August 2015 and WBC 16 Oct 2015.

Unit Price

*This represents an indicative level for unwinding your investment on the reporting date and is an indication of the market value of the investment.

Find out more about Sequoia Specialist Investments

Complete the form below and we’ll be in touch as soon as possible.

Key Risks:

- Returns: The Plan Return Amounts require ALL the shares to be above the respective Auto Call Level on the relevant Auto Call Date. If ALL the Shares are not higher than their respective Auto Call Levels any of the Auto Call Dates, then the Plan Return Amount will NOT be included in the Final Value

- Risk of Loss: If a Plan reaches maturity and the price of the Worst Performing Share in the Plan Basket is at or below the Knock-in Level (70% of the respective Starting Price for Plan 1) a Knock-in Event occurs and Investors will be exposed to the negative performance of the Worst Performing Share in the Plan Basket. Importantly, if the Worst Performing Share has fallen to zero, Investors will have lost their Total Investment Outlay (being the Issue Price per Unit and any Application Fee Paid).

- Counterparty Risk: Payment of the Final Value depends on the Issuer meeting its obligations and the Hedge Counterparty’s ability to meet their obligations under the Hedge. Investors are subject to counterparty credit risk with respect to the Issuer and the Hedge Counterparty.

- Early Maturity: The Units may mature early following an Early Maturity Event, including as a result of an Adjustment Event or Market Disruption Event or, if your request for an Issuer Buy-Back is accepted. If the Units are subject to Early Maturity, you will not be entitled to a refund of the Total Investment Outlay (comprising the Issue Price for each Unit and Application Fee payable) and other than in the case of an Auto Call Event, the amount that the Issuer receives from the Hedge Provider may be significantly less than would have otherwise occurred had the Investment reached Maturity.

Find out more about Sequoia Specialist Investments

Complete the form below and we’ll be in touch as soon as possible.